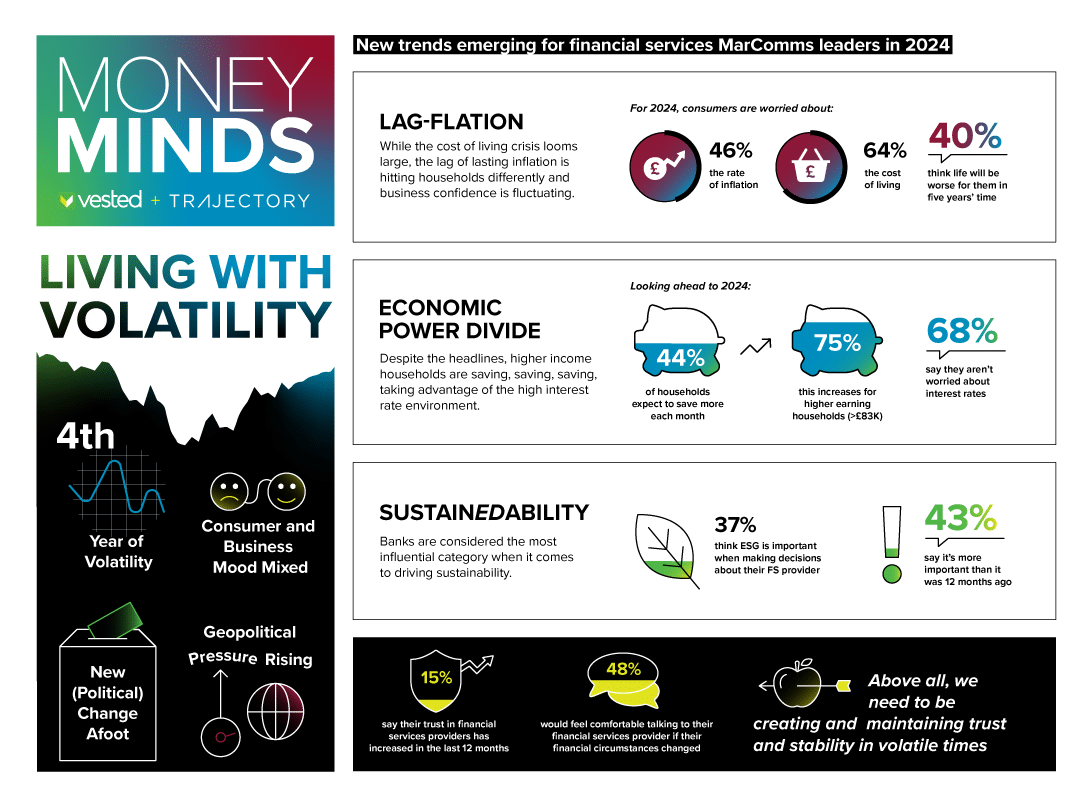

As the UK embarks on its fourth year of living with volatility, Vested and Trajectory have undertaken in depth trends research. Our MoneyMinds insight explores the key trends that are impacting the financial services marketers and communicators in 2024, against this backdrop.

Lag-flation:

The cost of living crisis continues to hit households, and the lag of lasting inflation is being felt by the business community and consumers. Lag-flation impacts our purchasing power and while incomes fail to keep up with inflation, there is lower demand for services.

For communicators and marketers, it’s vital that we consider how our audiences might be impacted by lag-flation – and what the long-lasting emotional and psychological impact might be on their spending behaviours.

Economic power-divide:

While we’re reading lots about the cost of living crisis, interest rates have been climbing and savings rates are at their highest in years. Higher income households have been saving hard and taking advantage of this.

Personalisation for different audience segmentations will be vital in 2024 and beyond. While some brands will ensure all communications are personalised to their audiences, others may try a one-size-fits-all approach.

Sustained-ability

Collectively, the financial services sector has a huge role to play in driving the ESG agenda, with consumers considering banks to be the most influential category.

For communicators and marketers, we must ensure we’re telling authentic stories around our sustainability agenda to overcome the various challenges associated with communicating our sustainability narrative.

Learn more about the research and the takeaways for your brand here

Want to Know More?

If you would like to book a session with the Vested team to hear about how these trends should inform your planning for 2024, please get in touch here.

"*" indicates required fields