Is Fintech Still the UK’s ‘Jewel in the Crown’?

Last week I attended Fintech Connect at London’s ExCel centre, one of the UK’s largest and best attended fintech events. With over 2,000 delegates, a packed 2-day agenda full of fascinating discussions, conflicting views and future-gazing, the action was non-stop. As you might imagine, one topic dominated above all else… AI in financial services.

Many hours were spent talking about how AI is being used across the financial services space, successes, learnings, and the widely held view that we’re so early on the adoption scale and that the true impact is yet to be felt. Yes, it’s all very exciting, but it’s also very… theoretical still. The main message, as it is across most sectors, is that the sector is still figuring AI out, how best to use it, regulatory impacts and so much more.

So today I’m not going to talk about that, I’ll save that for another blog. Today I wanted to talk about whether fintech is still the UK’s ‘jewel in the crown’.

Fintech has, for many years, been touted as the jewel in the crown of the UK’s startup ecosystem. But recently, with challenging market conditions and investment levels dipping, can the fintech industry still claim this pedestaled position?

Let’s start by taking a look at how the UK’s fintech sector is performing compared to its European and global counterparts. Data and graphics courtesy of Innovate Finance shows us the following in 2023:

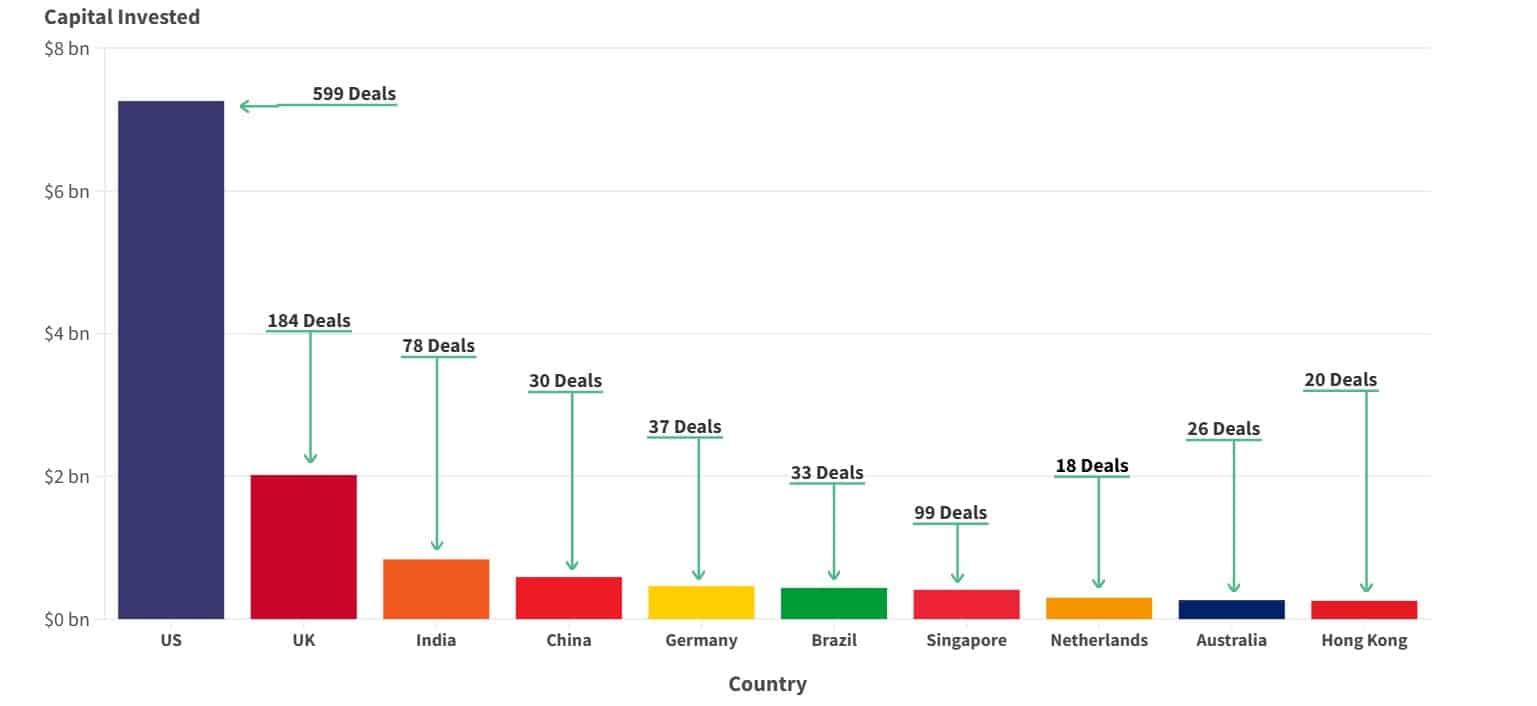

Top 10 global fintech markets 2023 (listed by size of investment)

In 2023 UK fintechs attracted the second largest amount of funding globally at $5.1bn. While this lags significantly behind the US (hardly any surprises there) it is still considerably ahead of any other country, with more than double the amount of investment compared to third-placed India ($2.5bn).

Zooming in closer to look at the European landscape in 2023, it’s clear that the UK is leading the pack by a considerable margin.

Top 10 European fintech markets 2023 (listed by size of investment)

It’s not just leading by capital allocation, it’s also way out ahead in terms of the number of deals done. There were more fintech deals (409) done in the UK in 2023 than there were in France, Germany, Switzerland, Netherlands, Spain, Sweden and Denmark combined.

2024 has gotten off to a similar start, with Innovate Finance data showing that in H1 2024, the UK retained its global second spot and European first spot when it came to capital investment and deal numbers.

This is all painting a rosy picture and it’s clear from these data points that the fintech sector in the UK is still thriving, although it’s a way off the dizzy heights of 2021 and 2022 when capital flowed much more freely. However, that’s the case globally and the big elephant in the room when it comes to fintechs in the UK is one of scale and opportunity.

The main issue here is not one of incubating and growing fintechs in the UK. The UK is still largely considered to be one of the best places globally to start a fintech business, as Innovate Finance’s data proves. This is for a number of reasons, including a strong talent ecosystem, globally beneficial time zone, a world-class education system and high consumer fintech penetration. This is why some of the world’s leading fintech brands are from the UK. The trouble we now face is keeping them here.

As is the case with other sectors, fintech brands looking to IPO are being tempted elsewhere by rosier markets. Indeed, you have to go back well over a year to the last fintech IPO in London, CAB Payments, which floated at a valuation of £851m in July 2023.

Cleary Labour are trying their best to encourage some of the UK’s ‘headline’ fintech brands like Revolut, Thought Machine and Zilch to list in the UK (as well as wider European fintech brands), but as Tim Levene, CEO of Augmentum Fintech, the largest fintech fund in Europe, said recently: “I would love there to be 20 or 30 truly disruptive fintechs that are listed in London, but we just don’t have enough data points in the listed market to be able to point to great outcomes that can encourage and incentivise other founders to say ‘Hey, let’s [list] a little bit early.’”

Overall, it was largely agreed amongst delegates at Fintech Connect that capital will continue to flow into UK fintech in 2025 and beyond, with the UK retaining its second place global position in the near future. However, in the longer term this is at risk of slipping, in part thanks to the public markets as other regions catch up. So while fintech absolutely still is ‘the jewel in the UK crown’ it’s certainly not a given that it’ll stay that way forever. The future is bright for the fintech sector in the UK thanks to the building blocks we’ve got in place here, but there’s a lot of work to be done to ensure it stays that way and that jewel doesn’t get stolen.