Brief

Grayscale had been operating Grayscale Bitcoin Trust for many years, but realized that it needed to successfully convert its product to a spot ETF in order to deliver the necessary returns for long standing investors and be able to gain further market share. The SEC and Gary Gensler had been portraying crypto as the Wild West and had struck down its application multiple times. Grayscale wanted to raise attention and put the SEC into the spotlight to urge it to reconsider the application.

While the #DropGold campaign set out to persuade people of the bitcoin investment opportunity, it also aimed to elevate the legitimacy of digital currencies as a whole. The campaign’s TV commercial was the first nationally aired ad of its kind. The campaign sparked an industry-wide debate about gold vs bitcoin. Additionally, the campaign introduced GBTC for the first time to a much wider retail audience – the only crypto investment product of its kind that provides investors with exposure to bitcoin through their brokerage accounts.

Approach

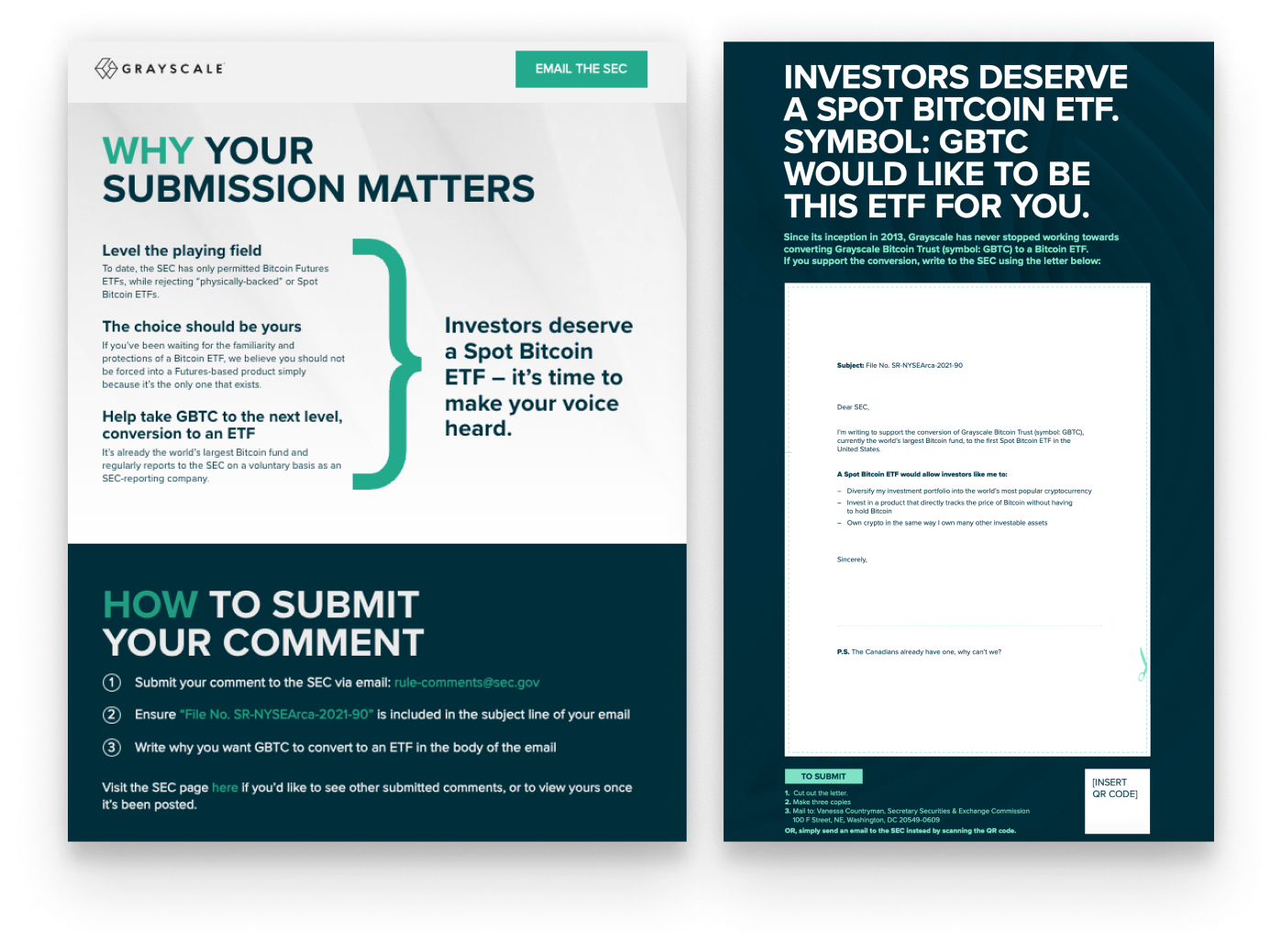

Vested focused on a dual-track campaign – one that focused on the SEC and trying to show that it cared about investors and that this is why the spot bitcoin ETF was important for investor safety. The second was focused on investor education and trying to show investors that they had a right to have access to a spot ETF.

Result

We pursued high-impact campaigns that included:

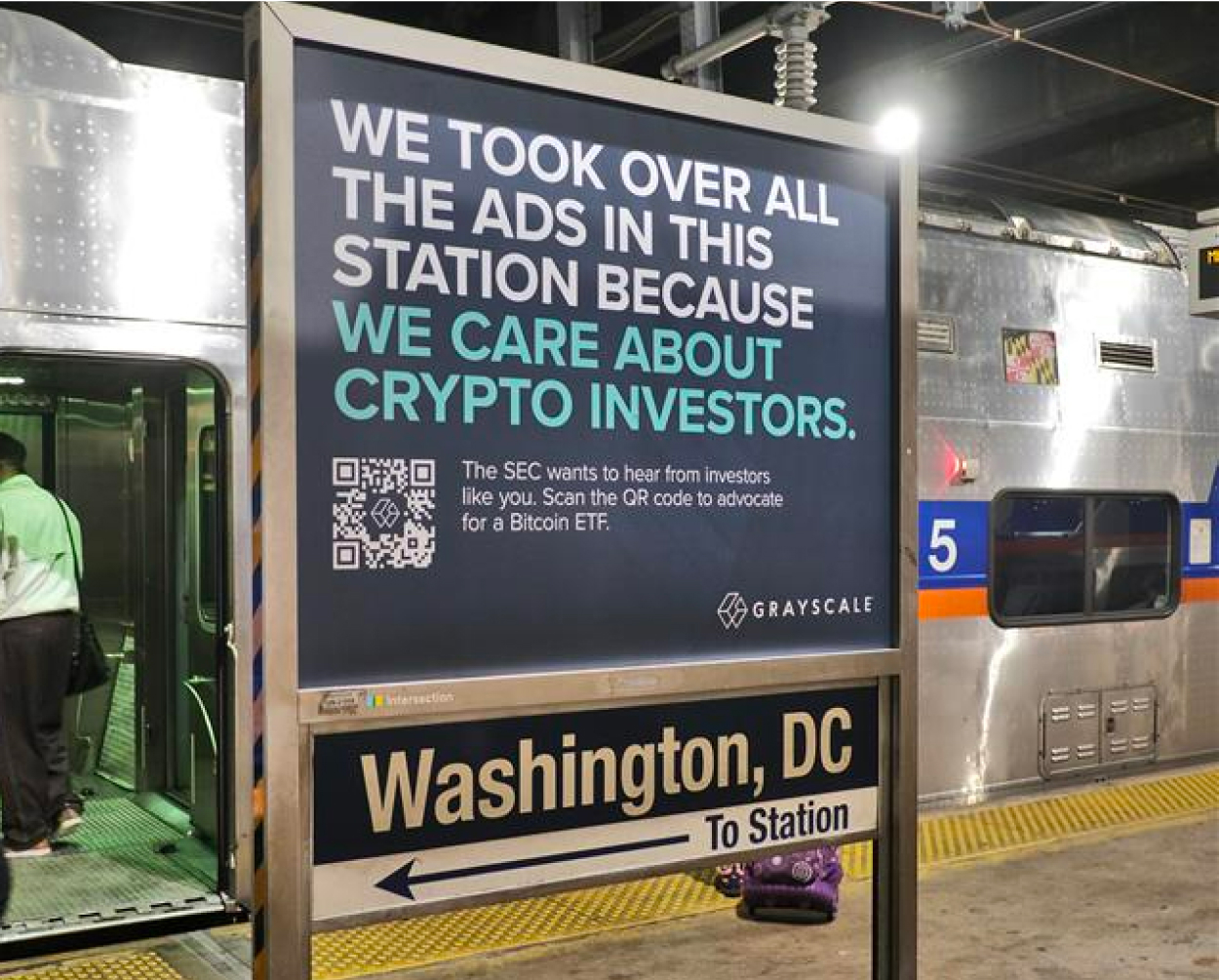

- Station advertising in Washington D.C.’s Union Station and New York City’s Penn Station

- Acela advertising on the Northeast Corridor, which connects NY to DC

- A simultaneous print ad campaign that hit on the same day in the New York Times, Washington Post, and Barrons. The ad contained a letter that investors could cut out and mail to the SEC.

- Digital advertising

- PR campaign and op-ed launch

Execution